Investing is not simply deals with saving your money through some

investments and forgetting about it. It is the best means of generating

second source of income with just the way you work hard to generate your

primary income at the initial stage, likewise even investing also

require your effort as it is for multifarious purpose. The purpose of

investing includes retirement corpus, to save taxes, to fulfill

financial goals like higher education and building assets. These are the

matters hardly to be trifled with. Allow us to see a couple of common investment mistakes that investors create.

The Right Time Syndrome

The world of finance suffers from the misunderstanding that finance is simply for wealthy. Hence, lots of earning people regress from investments or delay, waiting to possess a lot of monetary power before them starter motor investments. They look ahead to the “right time” and “right amount” before they begin investment. Within the method they lose one thing way more precious than short funds which is note value of cash.

Tax Investments for the aim for Tax Savings

Tax savings is one in every of the first considerations for any earning individual. However, during this race to save lots of taxes we regularly forget that tax saving investments may additionally act as goal fulfilling investments within the future. Simply before the twelvemonth ends there's a fulminant rush for investment within the tax saving merchandise. this is often a slip-up that investors make; failing to starter motor tax coming up with since the start of the twelvemonth.

Spending and Debt Traps

Earning people, once they get the primary style of cash sometimes pay while not a budget, disbursement a lot of quicker than they will earn back. Once this example continues, they need further support and people usually resort to private loans and MasterCard. The construct of loan is predicated on borrowing from your future financial gain.

Being uninsured and underinsured

Health insurance is another sort of insurance that ought to be a standard instrument of investment as a result of the rampant increase in health problem and worth of care facilities. People usually in haste get insurance dodged checking the coverage, to save lots of taxes. They usually fall prey to the info of insurance agents agency sell insurance merchandise for his/her own gains. These investment mistakes may prove fatal.

Differentiating Between Facts and Myths

Investing is one in every of those areas wherever there's an absence of awareness. Investors usually take selections supported info or alternative people’s concepts of finance and their experiences. This is often a slip-up as a result of each capitalist has their distinctive investment wants and should invest in step with that.

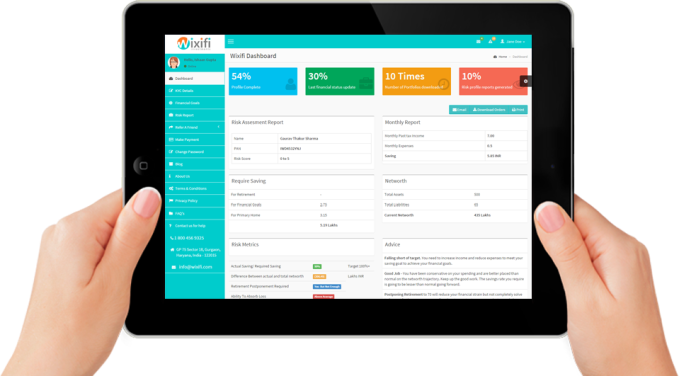

Investment could be a rigorous method that needs the investors to require active half. It’s your investment it's natural that your interest is piqued. Maintain the interest through the finance cycle. Avoid the common mistakes which frequently price heavily to the investors. Once you seal off these little pockets of mistakes your investments become air tight and that has no scope for losses or misinvestment. We have a tendency to all learn from mistakes and it's time you learnt from mistakes that you just may probably create however are higher of avoiding. For acquiring proper returns through your investments, hire an expert financial planner from a reputed firm like https://www.wixifi.com/

The Right Time Syndrome

The world of finance suffers from the misunderstanding that finance is simply for wealthy. Hence, lots of earning people regress from investments or delay, waiting to possess a lot of monetary power before them starter motor investments. They look ahead to the “right time” and “right amount” before they begin investment. Within the method they lose one thing way more precious than short funds which is note value of cash.

Tax Investments for the aim for Tax Savings

Tax savings is one in every of the first considerations for any earning individual. However, during this race to save lots of taxes we regularly forget that tax saving investments may additionally act as goal fulfilling investments within the future. Simply before the twelvemonth ends there's a fulminant rush for investment within the tax saving merchandise. this is often a slip-up that investors make; failing to starter motor tax coming up with since the start of the twelvemonth.

Spending and Debt Traps

Earning people, once they get the primary style of cash sometimes pay while not a budget, disbursement a lot of quicker than they will earn back. Once this example continues, they need further support and people usually resort to private loans and MasterCard. The construct of loan is predicated on borrowing from your future financial gain.

Being uninsured and underinsured

Health insurance is another sort of insurance that ought to be a standard instrument of investment as a result of the rampant increase in health problem and worth of care facilities. People usually in haste get insurance dodged checking the coverage, to save lots of taxes. They usually fall prey to the info of insurance agents agency sell insurance merchandise for his/her own gains. These investment mistakes may prove fatal.

Differentiating Between Facts and Myths

Investing is one in every of those areas wherever there's an absence of awareness. Investors usually take selections supported info or alternative people’s concepts of finance and their experiences. This is often a slip-up as a result of each capitalist has their distinctive investment wants and should invest in step with that.

Investment could be a rigorous method that needs the investors to require active half. It’s your investment it's natural that your interest is piqued. Maintain the interest through the finance cycle. Avoid the common mistakes which frequently price heavily to the investors. Once you seal off these little pockets of mistakes your investments become air tight and that has no scope for losses or misinvestment. We have a tendency to all learn from mistakes and it's time you learnt from mistakes that you just may probably create however are higher of avoiding. For acquiring proper returns through your investments, hire an expert financial planner from a reputed firm like https://www.wixifi.com/

No comments:

Post a Comment