If you want to build a career in mutual funds, you have to

consult a good mutual fund house to invest your fund. To build a brighter

future in mutual fund investments, you have to know where and when your fund

has to be invested. For this you have to need a financial planner. Before select

a financial planner, you have to think that you need a financial planner or

not and how to select the financial planner.

The work of Financial

Planner:

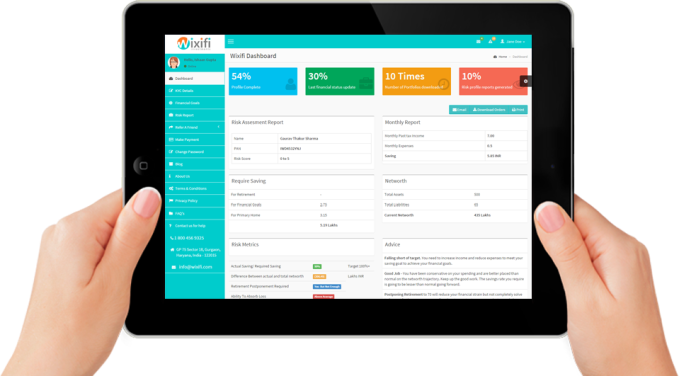

A financial planner is a person who evaluate your current

financial situation, analyze

your goals and design a map which will help you to reach your goals

comfortably. This includes allocation of asset management company and even

recommendations of which financial products to choose. The financial planner

expected to study your unique situation and will help you with an action plan.

If you follow the plan, it will diligently accelerate your journey towards

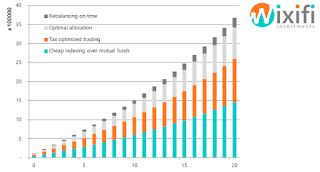

financial independence. A good financial planner will also offer periodic

reviews to ensure that your portfolio and asset allocations are optimized to

help achieve your financial goals.

Need of Financial

Planner:

There are several factors that determine whether you need a

financial planner or not. Many people believe that a financial planner is

needed only when you cross a certain asset size. If Personal finance is your passion and you

want to spend all your free time learning and implementing various , then you

would definitely benefit having a financial planner. You have to plan your

financial journey as early as possible.

The main thing is that you have to ensure that you choose

right financial planner. Financial planners can be classified broadly into fee

only, fee based and commissions only based on how they are compensated. Wixifi

is a best advisory firm which will help you to your unique situations. You only

pay them for advisory services and they recommend products that are optimally

suited for your needs. To know more details about their services, please visit https://www.wixifi.com/blog/index.php/all/strategy/financial-planners-do-you-need-one/